Top Story

ULI-LA StimULI Panel: Al Fresco Dining During and Beyond COVID-19

What are cities, developers and businesses doing to help the restaurant industry survive amidst the impacts of COVID-19?

November 19, 2020

Mickey Marraffino

Tues, Sept 29, 2020

This is the third webinar in a series designed to provide members with local perspective and insight into the Los Angeles Region, specifically as it relates to the challenging issues of today regarding social inequity in real estate. The panel addressed demographics, our history, and most importantly, creative solutions and innovative ideas we can use to develop a more equitable society as we embrace the culture that makes up Los Angeles.

As Allison Lynch, Co-Chair of Mission Advancement for ULI, stated, it is the hope this webinar series will “… leave us better prepared and informed to execute the ULI mission in our day-to-day lives; to provide leadership in the RESPONSIBLE use of land to create sustaining, thriving COMMUNITIES.”

Effie Turnbull Sanders Vice President, Civic Engagement and Economic Partnerships at USC, laid the foundation for this critical conversation by summarizing past unjust laws and regulations which devastated communities and, in some cases, wiped out cultures.

“We will see the impact that historic laws prohibiting Chinese Americans from owning land, internment of Japanese Americans, the use of eminent domain in Chavez Ravine, and the 10 Freeway’s urban renewal destruction had on communities with the least power — including the Eastside of Los Angeles’ Latinx neighborhoods to historic African American communities in Sugar Hill and Santa Monica. Limited home ownership opportunities have had tremendously devastating effects on our economy and has created a permanent underclass where people of color are at the bottom. We have an opportunity to talk about our path forward at this critical moment in history and make immediate change by learning from our panel of experts who will share some innovative solutions.”

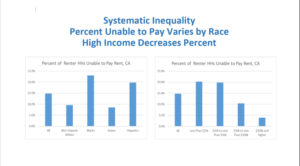

Panelist, Dr. Paul Ong UCLA Center for Neighborhood Knowledge discussed how the pandemic has impacted our current situation. Dr. Ong defined Systemic Inequality and Racism as “A system of interlocking processes that produce disparities across multiple arenas… creating implicit biases in individuals, groups, institutions, and the economy with race and class being the two fundamental divides.”

Dr. Ong showed how Systemic Inequality in the housing market has manifested itself during the pandemic with Blacks and Hispanics being a higher proportion of people in core urban areas who cannot pay rent/mortgage due to financial precariousness, jobless exposure, exclusion from new COVID-19 economic safety net programs and general lack of health and education resources. All of this points to a potential wave of homelessness by the end of this year because many of these households will have accumulated huge debt.

Dr Richard Green, Director, USC Lusk Center for Real Estate provided more current context by elaborating on the concept of disparate impact and how “race neutral” land-use policies can have a negative impact on neighborhoods. Dr. Green began by pointing out that historic policies which appeared to be race-neutral were “just plain-old racist policies”.

For example, use of FICO scores to determine who can purchase a home appears to be race-neutral, but there are 26 million people in this country who have no credit history: which means they are “credit invisible”. This applies to young people who have not yet developed credit through paying bills and using credit cards, but it also applies disproportionately to people of color, immigrants and older people who use cash/checks to pay for everything, including utility bills and rent.

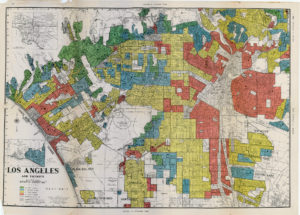

Dr. Green further discussed the history of redlining and urban renewal of the 1950’s, the residential mortgage crisis of 2008, and the current pandemic to illustrate their impacts on home ownership and wealth building in disadvantaged communities. Dr. Green cited two studies which show it would take more than 200 years to create equality once racism ceases to exist, and that the number one predictor of home ownership is: if your parents owned a home.

1939 Homeowners’ Loan Corporation redlining map

During the Great Depression it was impossible to refinance due to poorly structured mortgages, therefore lending institutions created the 15-year fixed rate mortgage which was only available to homeowners in the blue and green area of the map. It was impossible for homeowners in the red area to qualify for this loan and these residents lost their homes. An entire generation of people of color who owned homes, lost their homes during this period.

During the Mortgage Crisis of 2008, we saw a similar situation with sub-prime mortgages and predatory lending. During this period many African-Americans were eligible for the best loans, but were convinced to take on sub-prime loans that had low initial payments and balloon payments later in the loan period which caused them to lose their homes.

Today, during the COVID-19 pandemic, interest rates are exceptionally low, and it is less expensive to own a home than it is to rent. However, because people of color are disproportionately unemployed during this time, they are not eligible for these low-interest mortgages.

These examples show a continuous trend of providing exceptional home ownership opportunities to white people, while black and brown people do not have the same access. The lack of affordability trend is further illustrated in the Los Angeles African American communities with the peak population representing 12-13% of residents but today, this demographic only represents 7-8% of the area.

Michael Anderson, Principal, Anderson Barker Architects, presented solutions addressing current needs revolving around reduced public transportation income due to COVID-19, the housing shortage, lack of home ownership, and reliance on automobiles. Anderson Barker Architects also authored the Metro Crenshaw/LAX Transit Corridor TOD study.

Starting with a Public Private Partnership between developers, the city and Metro, Mr. Anderson suggests creative entitlement and land sales that include additional Metro stations and concludes with a village being built in an extremely fast 5-year period. “Combining the land assembly and home-ownership approach creates an economic chemistry that delivers Metro reinvestment opportunities and 60,000 housing units a year”, he explained.

One of the long-time concerns regarding gentrification in these types of projects is that it changes the culture of the community and displaces disadvantaged people. Mr. Anderson’s solution is to find ways to build housing for the children of the residents which will preserve the culture and unique attributes of the community.

Why would lending institutions want to do this? Mr. Anderson suggests amending legislation around the Community Reinvestment Act to support banks taking an equity position therefore they will have tangible real estate and earn the equity position benefit when the property sells.

Rudy Espinoza, Executive Director of Inclusive Action for the City – assists communities that have been left out and undervalued but demonstrate a tremendous amount of entrepreneurial spirit. Through advocacy they bring people together to build strong local economies that uplift, low-income, urban communities. This organization develops unique economic development initiatives designed to build assets for communities of color.

In 2009 Inclusive Action began the process to legalize Street Vending, which was legal in all major US cities except Los Angeles, further illustrating how local land-use policies were designed to criminalize black and brown entrepreneurs.

Inclusive Action worked with Street Vendors and entrepreneurs to empower and educate them to be advocates and speak on behalf of their efforts. Nine years later, effective December 2018, Los Angeles legalized Street Vending. Today, the LA County Board of Supervisors invested $1million to create a pilot program to develop affordable vending carts, which is typically the next hurdle the entrepreneurs face.

Mr. Espinoza says, “The ‘Path Forward’ includes thinking about the distribution of capital, not just systems change” which is also addressed by Anderson with his recommendation to amend the Community Reinvestment Act.

It’s imperative we shift our thinking when projecting ROI and how we can start addressing wealth gap issues and inequality so we can build a more inclusive Los Angeles.

Creative thinking about ROI includes not simply look at the dollars returned but also the value of social equity. Ultimately, we need to think broader and help investors realize the importance of social equity and how they gain results in long-term asset growth and overall economic benefits.

Don’t have an account? Sign up for a ULI guest account.